What DeFi Is

Truly Meant to Be!

VY Token Contract

VY Token Contract

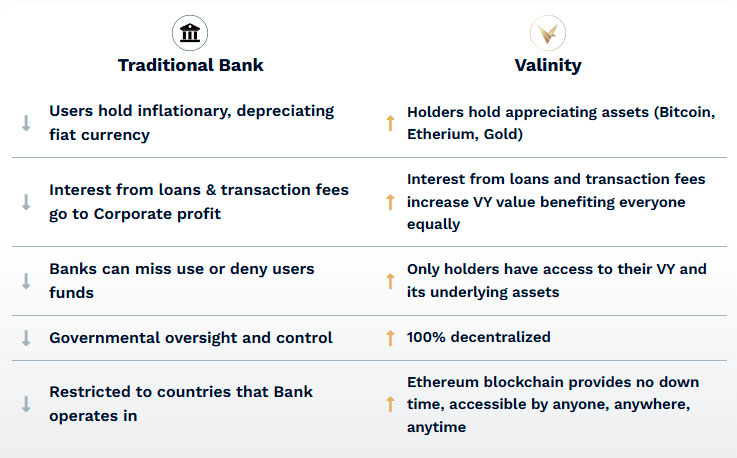

Backed by Bitcoin and Ethereum, Valinity thrives during bull markets, while Gold ensures growth in bear markets—making it a strong asset under any market conditions.

Continuous asset acquisition ensures VY not only benefits from its reserved assets performance but outperforms them.

By VY holders accessing capital through collateral loans it reduces selling pressure positively impacting VY’s price.

Backed by Bitcoin and Ethereum, Valinity thrives during bull markets, while Gold ensures growth in bear markets—making it a strong asset under any market conditions.

Continuous asset acquisition ensures VY not only benefits from its reserved assets performance but outperforms them.

By VY holders accessing capital through collateral loans it reduces selling pressure positively impacting VY’s price.

No due dates or risk of liquidation. There’s no pressure to pay back your loans—enjoy liquidity while still holding onto your appreciating asset, VY.

As Valinity continuously acquires more assets. You can refinance your loans to unlock even more capital.

Valinity turns market volatility into liquidity opportunities ! by repaying loans on a depreciated asset and taking a new loan on a appreciated one.

ETH Acquired

÷

Circulating VY

=

Every single VY is minted by adding assets to the Valinity Reserve treasury

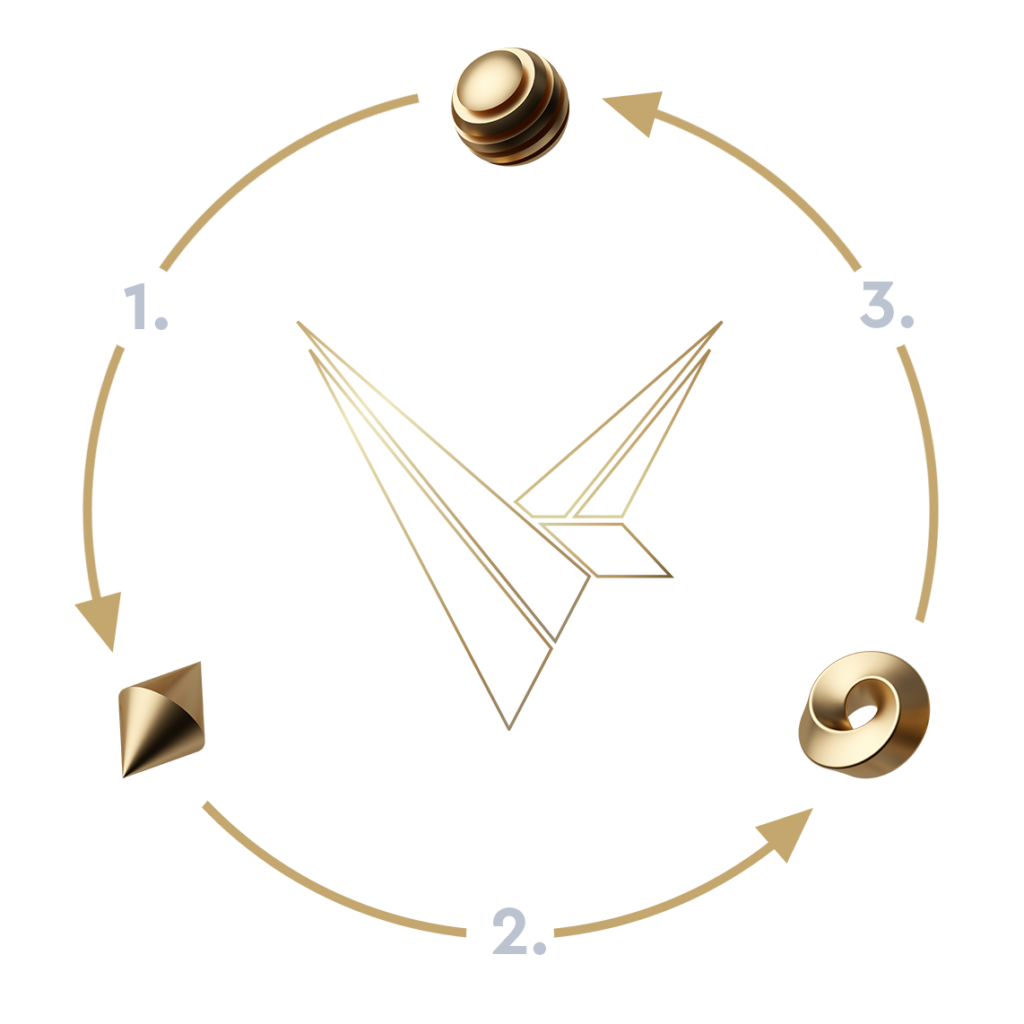

The VRT stores all ETH acquired by the VAT, which can be loaned by collateralizing VY.

The VCT stores all collateralized VY used for loans and sends Interest charged in VY to the VAT.

1.

All Ethereum acquired by the Valinity Acquisition Treasury is sent and locked in the Valinity Reserve Treasury.

2.

Users can get a loan in Ethereum from the Valinity Reserve Treasury by collateralizing their VY in the Valinity Collateral Treasury.

3.

When VY is collateralized in the Valinity Collateral Treasury for ETH, interest is charged in VY and is sent back to the Valinity Acquisition Treasury taking them out of circulation, along with all VY transaction fees.